child tax credit october 2021 delay

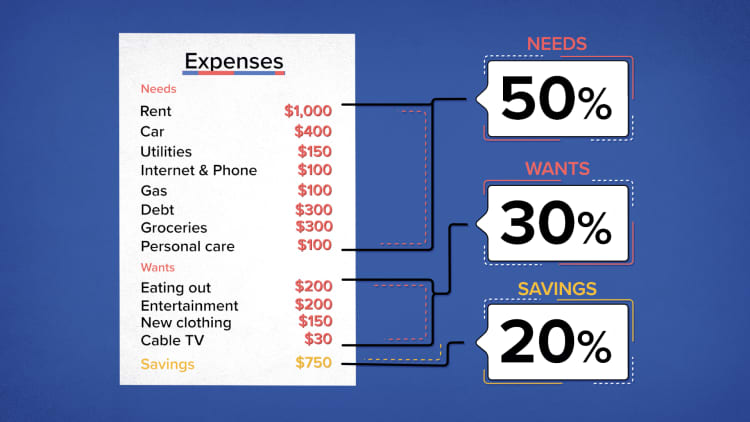

The fourth monthly payment will go out on October 15 so you should expect to receive either 300 or 250 dollars depending on your personal situation. The IRS has sent letters to those who have yet to file a tax return.

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Khou Com

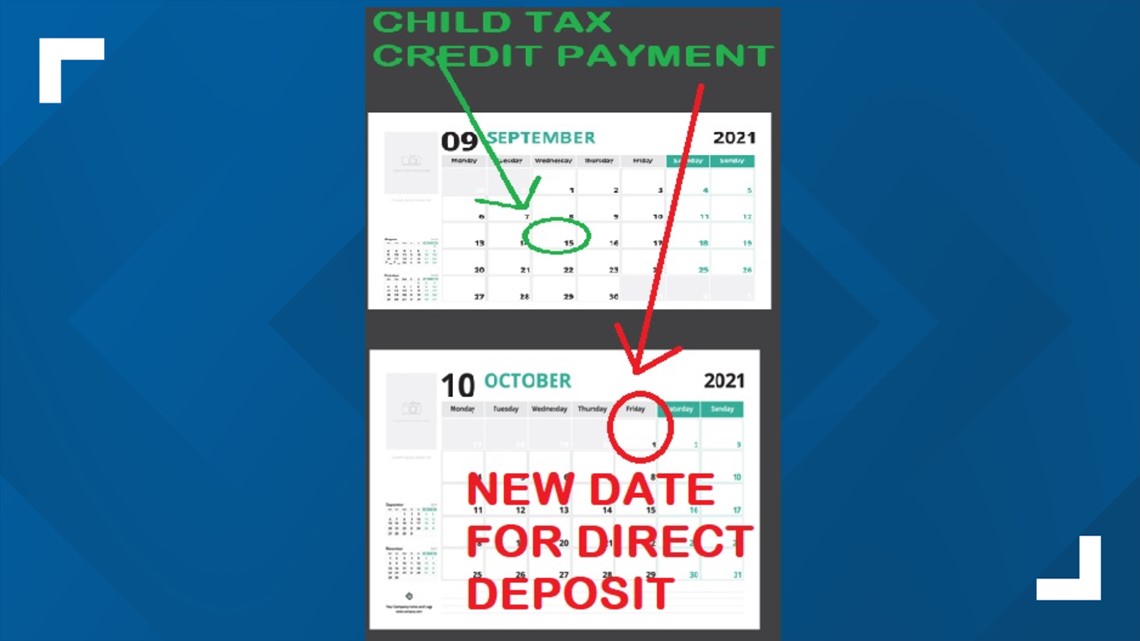

The IRS on Friday release declared that due to a technical issue the payments for the last month got delayed for a small number of advance child tax credit.

. Two more payments still. This funds are still available and just waiting to be claimed. In an effort to reach the 9 million individuals and families who had not filed a 2021 return the IRS sent letters in English and Spanish to notify them about three credits.

The deadline to claim stimulus checks and the 2021 child tax credit is 15 November 2022. Nearly 10 million eligible individuals havent yet received Stimulus payments or 2021 child tax credits. It is worth remembering.

Under the American Rescue Plan most eligible families received payments dated July 15 August 13 and September 15. A technical issue last month caused issues like late payments but this month there should be fewer issues. With families set to receive 300 for each child under 6 and 250 for each.

The Child Tax Credit provides money to support American families. As part of the. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

Until the end of 2021 Child Tax Credit stimulus checks will be mailed on the 15th of each month. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

Under the program parents of eligible children under 6 receive 300 per child each month while those with children between 6 and 17 get 250 per child. Visit ChildTaxCreditgov for details. If you still have questions or concerns regarding your Child Tax Credit check you.

1200 sent in April 2020. Future payments are scheduled for November 15 and. In 2021 the child tax credits were temporarily boosted to 3600 from 2000.

Enhanced child tax credit. Families are just now starting to get their October child tax credit. The Advance Child Tax Credit CTC monthly payments from the American Rescue Plan Act ARPA were administered to more than 35 million households with children in the.

FAMILIES who are claiming child tax credits may have to wait longer for a tax refund than they expect. The IRS began sending out the fourth of six monthly child tax credit payments on Friday 15 October. Here are the details.

The child tax credits are worth 3600 for kids below six in 2021 3000 for those between six and 17 and 500 for college students aged 18 to 24. T he IRS started sending out the fourth lot of Child Tax Credit payments on October 15 and millions will have already received this money either via direct deposit or by mail. October 16 2021.

With only four more payments hitting bank accounts this year parents who want to receive the child tax credit need to register by October 15 Credit. Eligible individuals are getting a monthly payment of up to 300 for reach child under 6. Have been a US.

Individuals earning less than 75000 and married couples earning less than 150000 qualify. Those with children ages 6 to 17 can expect 250 per child. Here is some important information to understand about this years Child Tax Credit.

For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days to. Getty The deadline to sign up. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021.

The total value was 17 billion with the average familys payment totaling about 416.

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

Tas S Ability To Help With Delayed Refunds Is Limited Taxpayer Advocate Service

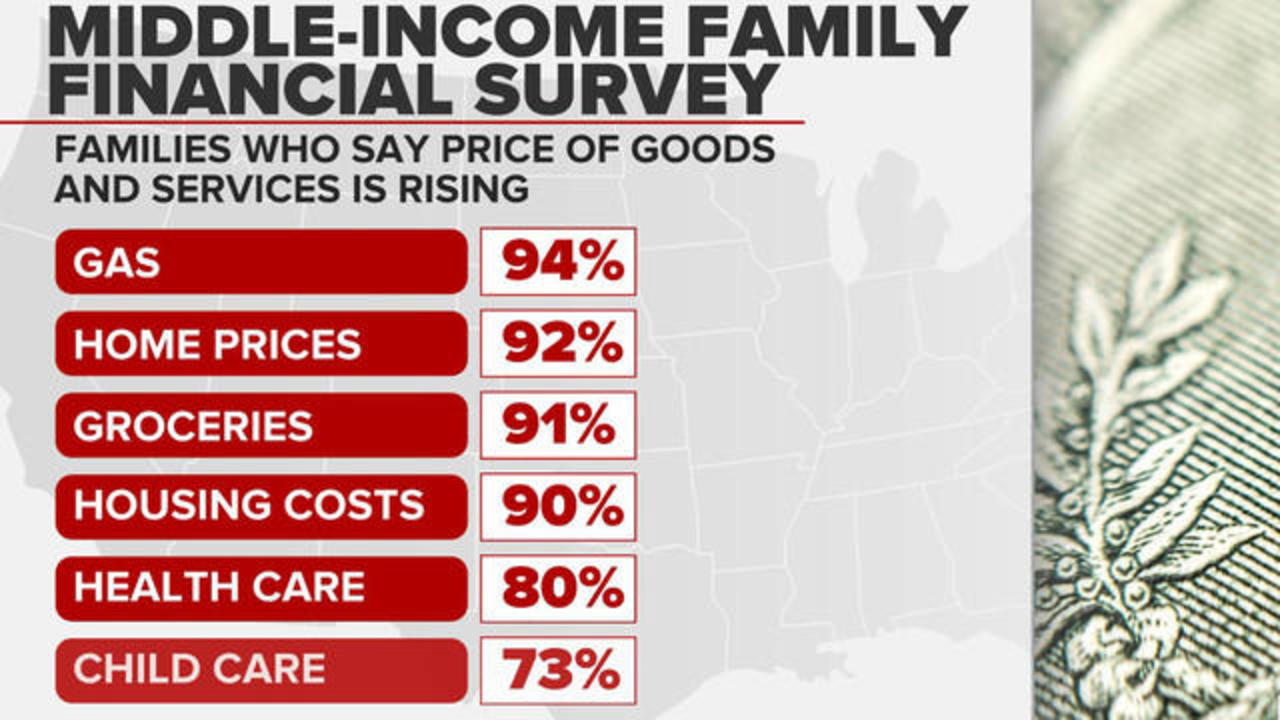

Harder To Pay The Bills Now That Child Tax Credit Payments Have Ended

The Monthly Child Tax Credit May Last For Just 1 More Year

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Some Child Tax Credit Payments Delayed Or Less Than Expected Irs Says Al Com

Child Tax Credit Irs Unveils New Feature To Help Avoid Mailing Delays

Latest Child Tax Credit Payment Delayed For Some Parents Cbs News

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

Child Tax Credit Updates Why Are Some Payments Lower In October As Usa

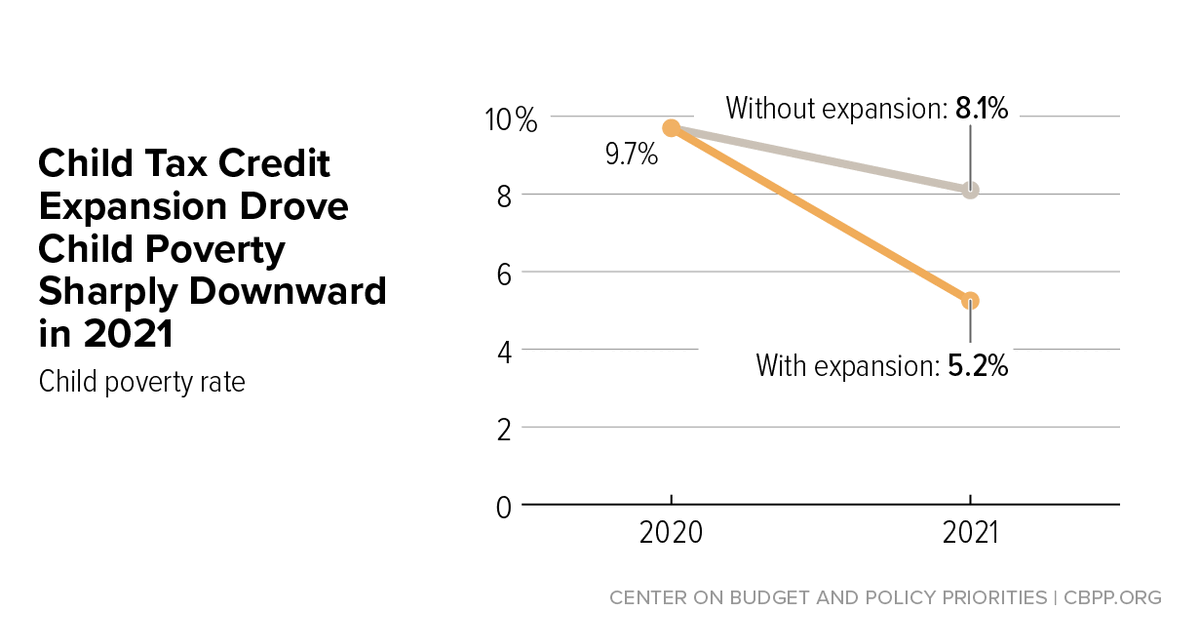

Policymakers Should Expand Child Tax Credit In Year End Legislation To Fight Child Poverty Center On Budget And Policy Priorities

Stimulus Update 5 Reasons Your October Child Tax Credit Payment Hasn T Arrived Yet

Should I Opt Of Child Tax Credit In 2021 11alive Com

Latest Child Tax Credit Payment Delayed For Some Parents Cbs News

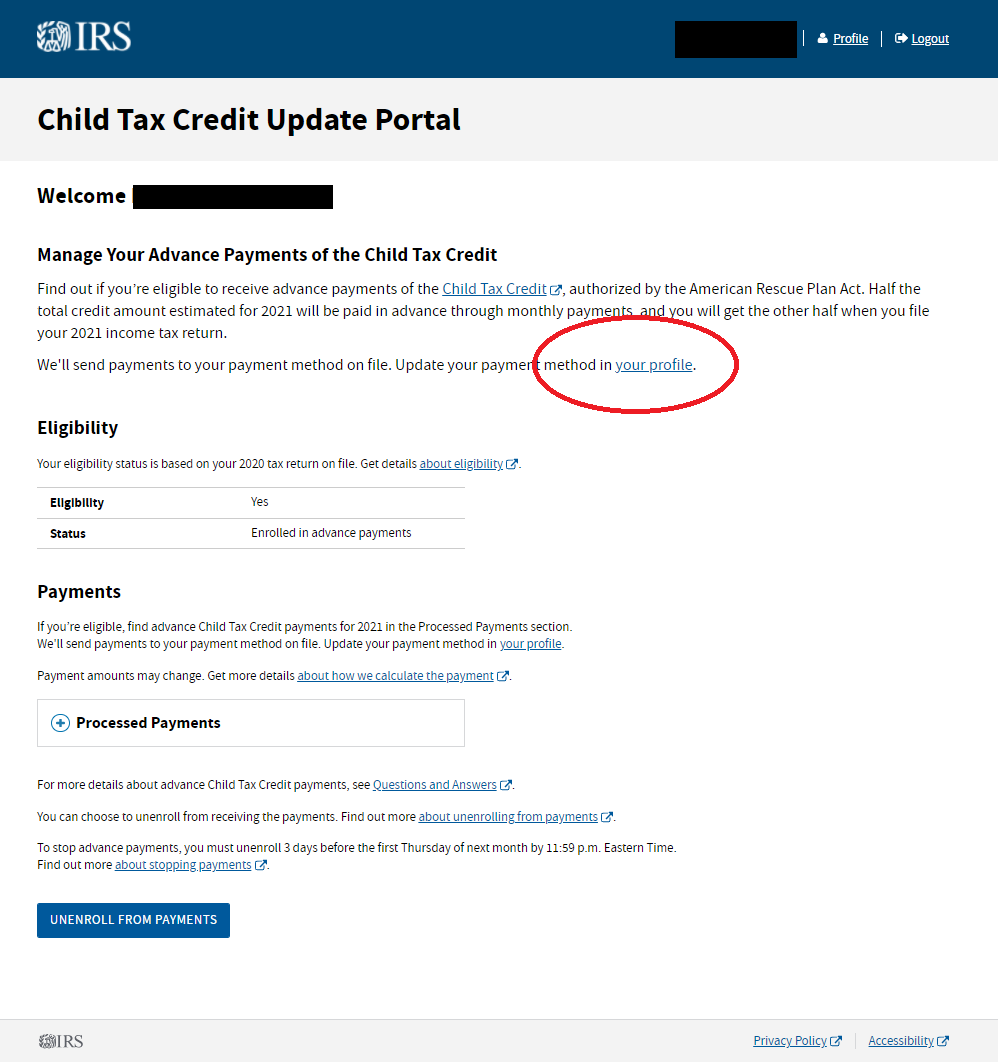

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Some New Yorkers Will Get An Unexpected Payment When They Check Their Mail In The Coming Weeks

Irs Delays Some September Child Tax Credit Payments Until Oct Wfmynews2 Com

October Child Tax Credits Issued Irs Gives Update On Payment Delays

Failure To Raise Debt Ceiling May Delay Social Security Child Tax Credits What To Do If You Need Money Now Fox Business